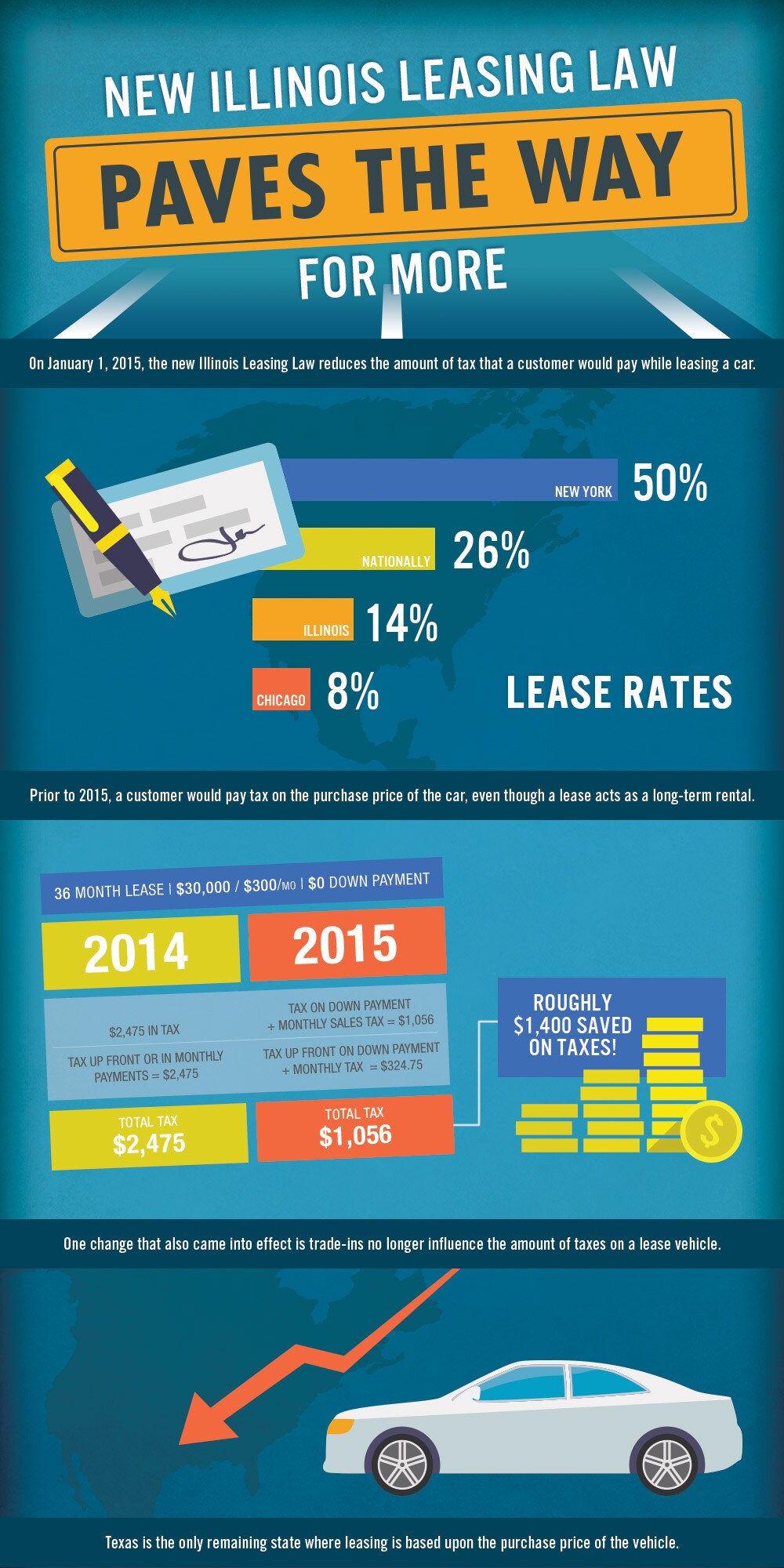

In 2015, Illinois made a considerable shift in how automobile leasing is exhausted, making it a much more enticing option for consumers. Prior to this adjustment, leasing a lorry was often less appealing as a result of the high taxes related to the purchase cost of the cars and truck. Clients paid tax obligation on the full value of the automobile, although a lease was more like a lasting rental. Under the brand-new Illinois Leasing Law, taxes are now only applied to the down payment and the monthly payments, which dramatically minimizes the overall tax obligation problem. As an example, a consumer renting a vehicle for $30,000 saw a tax obligation cost savings of around $1,400 in 2015, compared to the previous system. This reform brought Illinois much more in accordance with various other states, where leasing is already taxed extra positively.

The law's adjustments prolong beyond simply tax obligation savings. With the 2015 regulation, trade-ins no longer influence the tax computation for leased automobiles. Illinois' new regulation brings the state more detailed to nationwide standards, and its effects are felt by anyone considering leasing a cars and truck, providing significant tax savings and simplifying the leasing procedure for customers throughout the state.

Check for more info at Bill Walsh Kia Facebook Twitter

Navigation

Latest Posts

Unlock Incredible Bargains on Second-Hand Car Deals at Bill Walsh Ford

Most Popular Fuel Savers at Bill Walsh Chevy in 2025

Why Choose a Qualified Used Lorry?